7 Habits of Financially Confident People

Build discipline, ditch debt, and take control of your money mindset.

Confidence in your finances doesn’t come from having six figures in your bank account—it comes from consistent, empowered actions. Financially confident people don’t rely on luck or high income. They master small habits that lead to big wins.

At Money Tree Financial Services, we believe confidence is a skill that anyone can build. Here are seven habits that financially confident people practice—and how you can start applying them today.

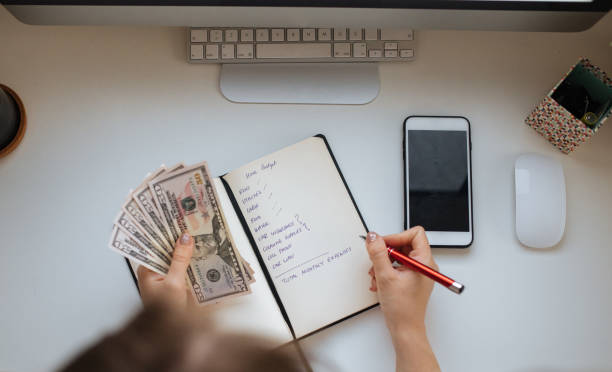

1. They Know Where Their Money Goes

Financially confident people track their income and expenses. They use budgeting tools, mobile apps, or old-school spreadsheets—but no dollar goes unnoticed.

Try This:

Set a reminder to review your spending every week. Use tools like Mint, YNAB, or our free budgeting templates to gain clarity.

2. They Live Below Their Means

Living below your means doesn’t mean deprivation. It means making intentional choices that align with your values—not impulse or comparison.

Try This:

Before every non-essential purchase, ask: “Does this help me reach my financial goals?”

3. They Pay Themselves First

Confident people treat saving like a non-negotiable expense. Whether it’s $20 or $200, they set aside money before spending on anything else.

Try This:

Automate a weekly or monthly transfer to a savings account—even a small amount adds up.

4. They Set Financial Goals and Track Progress

From paying off debt to saving for a home, financially confident people set clear goals—and revisit them regularly.

Try This:

Write down one short-term and one long-term financial goal. Break each into manageable milestones and celebrate progress along the way.

5. They Invest in Financial Education

They stay curious. They read books, attend webinars, or work with financial coaches. They know knowledge is power.

Try This:

Subscribe to our monthly newsletter or enroll in a Money Tree course like “Budget Breakthrough” or “Credit Confidence.”

6. They Plan for the Unexpected

Emergencies happen—but confident people are prepared. They have an emergency fund, insurance coverage, and estate planning in place.

Try This:

Start building an emergency fund with a goal of $500, then grow it to 3–6 months of expenses.

7. They Focus on Progress, Not Perfection

Financially confident people don’t let setbacks derail them. They understand that mistakes are part of the journey—and they keep moving forward.

Try This:

Give yourself grace. Review what went wrong, adjust your plan, and recommit with a fresh mindset.

You Can Build These Habits Too

Confidence doesn’t happen overnight—but every step you take today creates the future you want tomorrow. Start small. Be consistent. And if you need support, Money Tree Financial Services is here to guide you with tools, coaching, and real-world strategies.

Ready to take control of your financial life?

Let’s grow your confidence—one habit at a time.

Responses